I once thought I could handle mixing my personal and business finances. After all, I’m an accountant, right? I figured it was just a matter of keeping a spreadsheet or two. But then came tax season, and I found myself knee-deep in a mess of receipts, trying to recall if that lavish dinner was a client meeting or just me treating myself to a steak. Spoiler alert: the IRS doesn’t care about your memory lapses. That was the year I learned the hard way that commingling finances is like trying to untangle your earbuds after they’ve spent a week at the bottom of your bag. A tangled, chaotic nightmare.

So here’s the deal. This article isn’t going to sugarcoat the importance of separating your business and personal finances. I’ll walk you through why opening that business bank account isn’t just a suggestion—it’s your lifeline. We’ll touch on the differences between an LLC and a sole proprietorship, and why slapping the word “sole” on your business card might not be the best move. Plus, I’ll share some accounting tips to keep you from pulling your hair out next tax season. Stick around if you want to avoid the kind of financial chaos that makes you question your life choices.

Table of Contents

Why My Bank Thinks I Have Split Personality Disorder: The Tale of Two Accounts

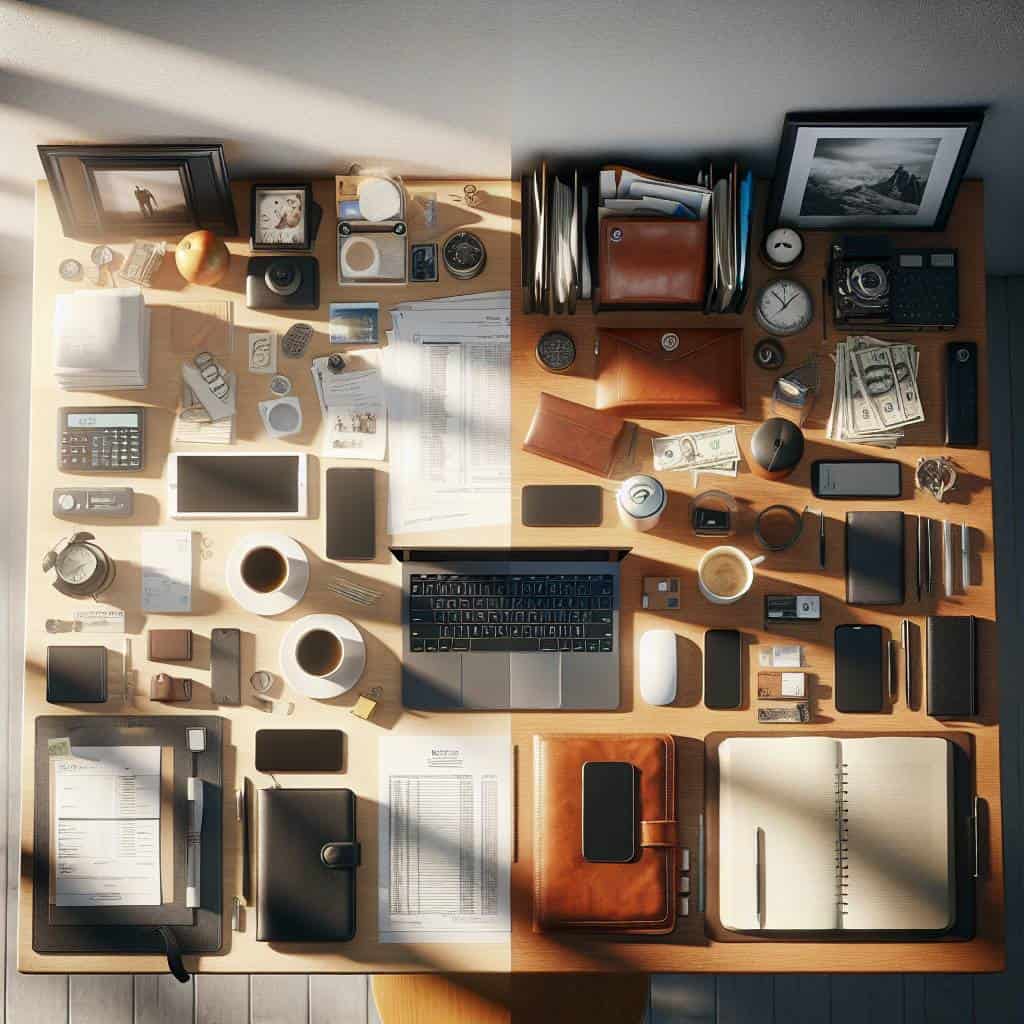

Picture this: I walk into the bank, ready to open a new account, and the teller looks at me like I’ve lost my marbles. I get it. To them, it must seem like I’ve developed some sort of financial schizophrenia. But here’s the thing—keeping my business and personal finances tangled up together is like trying to run a marathon with my shoelaces tied together. Not smart. So, I’ve got two accounts: one for me, the suburbanite who buys groceries and pays the electric bill, and one for the accountant who runs an LLC and needs to keep track of business expenses like a hawk watching its prey.

Here’s why this isn’t just some accountant’s obsession with neat columns and tidy spreadsheets. When you mix personal and business funds in one account, it’s like inviting chaos to a party that should be all about clarity. Imagine trying to explain to the IRS why the money for your new laptop came from the same pot as your weekend getaway. Not exactly a fun conversation. Plus, if you’re a sole proprietor thinking of growing into an LLC, those separate accounts aren’t just handy—they’re essential. They help establish your business as a separate legal entity, which is a fancy way of saying if something goes wrong, your personal finances might not have to suffer the consequences.

And let’s talk accounting for a second. When everything’s jumbled, tracking business expenses becomes a nightmare. You want to spend hours sorting through transactions, figuring out which ones are deductible? Neither do I. But when you’ve got everything split neatly into two accounts, you can see exactly where the money goes, making tax time less of a horror show. In short, having two distinct accounts makes life easier, not just during tax season, but every day. It keeps the confusion at bay, and in this world, that’s priceless.

The Financial Fork in the Road

Mixing your personal and business finances is like trying to run a marathon with your shoelaces tied together. You’ll trip over your own numbers before you even get started.

The Sweet Freedom of Financial Sanity

There’s a strange kind of peace that comes from knowing your dollars are marching in the right parade. My business account doesn’t see my personal pizza orders, and my personal account doesn’t get to fund my LLC’s experiments with new accounting software. It’s like having a tidy room in a chaotic world. I know where everything is, and more importantly, I know what each thing is supposed to do. The IRS might not be sending me Christmas cards, but at least they’re not sending me any nasty surprises either.

This journey of separating business from personal isn’t just about dodging financial disasters—though that’s a nice perk. It’s about clarity. It’s about drawing lines in the sand and sticking to them. And honestly, it’s not as tedious as it sounds. Once you get past the initial setup—the LLC papers, the new accounts—it’s like riding a bike. The simple act of keeping things where they belong, of not letting them mingle and muddle, is liberating. It’s a small rebellion against chaos. And in my world, that counts for a lot.