I’ve got a confession to make: I once bought a $400 gadget because it was “marked down” from $500. There I was, a supposed numbers whiz, falling for a price tag illusion like a rookie. The thing is, I didn’t need another tech toy cluttering my desk, but that little red sticker convinced me otherwise. It felt like a victory, even though I knew deep down I was playing right into the retailer’s hands. That’s the beauty and the curse of pricing psychology—it taps into that part of our brain that loves a good deal, even if the “deal” is nothing but smoke and mirrors.

Now, if you’re like me—skeptical yet somehow still ensnared by these pricing tricks—you’ll want to stick around. We’re diving into the nitty-gritty of how these tactics manipulate our wallets. I’ll pull back the curtain on strategies like charm pricing, where $9.99 feels cheaper than $10, or the decoy effect, a sneaky way to steer choices. We’ll also tackle anchoring and premium perception, giving you the know-how to see through these ploys. No fluff, just the straight-up truth about how retailers are playing us—and how you can stop them.

Table of Contents

Why My Wallet Fell for the Decoy Effect: A Tale of Price Tags and Deception

There I was, standing in the electronics aisle, staring at three versions of the same gadget. One priced at $50, another at $100, and the third—oh, the cunning third—at $120. I knew the game, or so I thought. The $100 option seemed like the obvious choice, a bargain sandwiched between “cheap” and “luxury.” But that $120 price tag? It was the decoy—the Trojan horse of retail. It existed solely to make the $100 model look like a steal. I fell for it, hook, line, and sinker. And my wallet? Well, it took the hit.

This sly tactic is known as the decoy effect, and it’s a masterclass in manipulation. Pricing psychology is all about perception. Anchors, decoys, and charm pricing—they’re the trinity of tricks used to nudge us toward decisions we think we’re making on our own. But here’s the thing: we’re not. The decoy doesn’t just sit there, doing nothing. It whispers, “Look at me. I’m here to make the middle option shine.” It’s the magician’s assistant of pricing strategies, diverting attention while the real trick unfolds. And in the end, I walked away, $100 poorer, thinking I’d snagged a deal. In reality, I’d been played like a fiddle.

What’s worse? These tactics thrive on our trust in numerical logic. Numbers, after all, should be honest. But retailers know that they can charm us with cents, dazzle us with decimals, and anchor us with strategic placement. We’re led to believe we’re savvy shoppers, but the truth is, we’re navigating a psychological minefield. And unless we wise up, our wallets will keep taking the fall. So next time you’re eyeing that tempting trio of products, remember—sometimes, the real con artist isn’t the price tag itself, but the invisible hand guiding your choice.

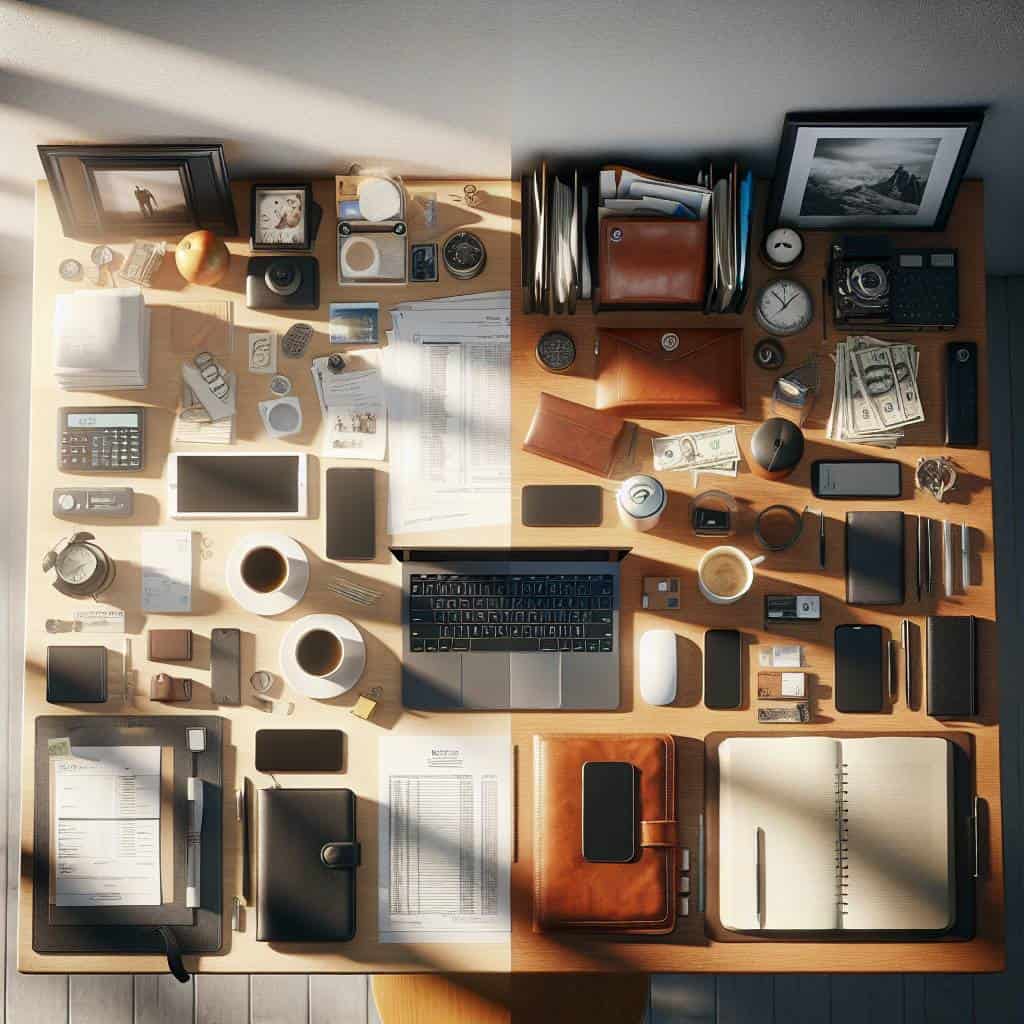

The Illusion of a Good Deal

Price tags are the magicians of the retail world, making us see value where there is none. It’s all smoke and mirrors, and we’re the willing audience.

The Price of Insight

In peeling back the layers of pricing psychology, I’ve found myself wandering through a world where numbers play tricks and perception is everything. It’s like discovering the secret handshake of marketers and realizing how often my wallet’s been the sucker in this game. Charm pricing, decoys, anchoring—these aren’t just fancy terms. They’re the tools of an industry that knows exactly how to make us feel like we’re getting a deal, even when we’re not. It’s both fascinating and frustrating to see how easily our brains are led down the garden path with a cleverly placed ‘99’ or a strategically set decoy.

But here’s the kicker—knowing all this doesn’t make me immune. It just means I’m a bit more aware as I navigate the minefield of price tags. So, the next time I’m standing in the aisle, debating between the ‘premium’ brand and its cheaper cousin, I’ll remember this journey. It’s not about rejecting the tricks outright but making conscious choices amidst the illusion. And maybe—just maybe—I’ll walk away with a little more wisdom and a little less buyer’s remorse.